Can I Still Register For Subsidized Loan After Fafsa

Straight Subsidized/Unsubsidized Loan Timeline to Disbursement

Awarding of Direct Subsidized/ Unsubsidized Loans

We process educatee fiscal aid offers in two cycles. We volition begin to offer New Students aid packages in Feb (returning students will begin to receive their aid offers in July) for the upcoming academic twelvemonth. You will receive a Financial Aid Notification via email once your financial aid is available to view in LionPath.

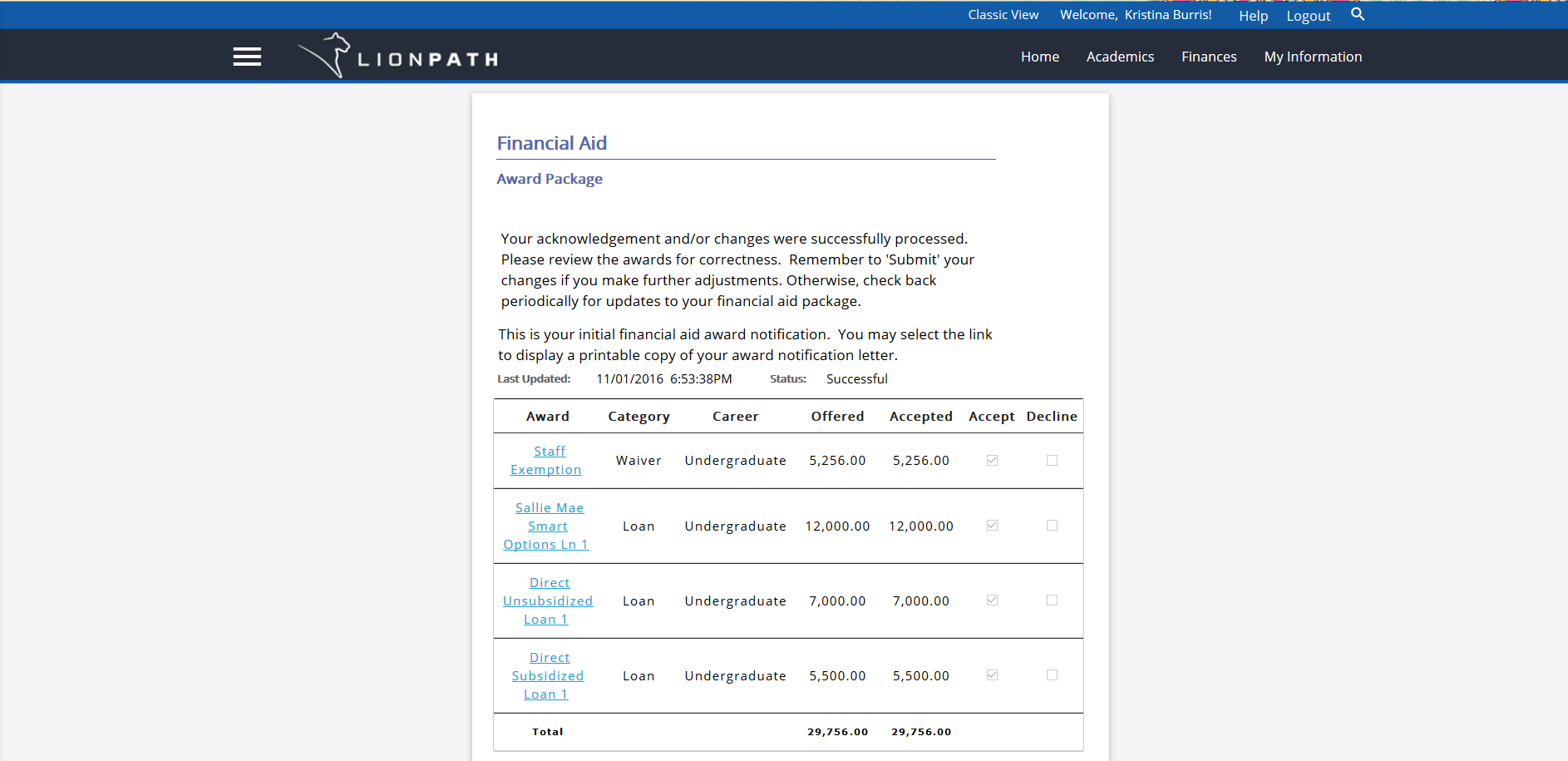

How to Accept Your Loan(s)

In one case your loan has been offered to you each academic year, you need to take, decrease, or decline your loans in LionPATH. Continue in mind that nosotros typically award for both Fall and Spring together, so you are accepting the total amount for the year.

If you are a new educatee, this option volition be bachelor after:

- Your Penn State account is fully activated

- You have completed the Financial Responsibility Agreement

- We have turned on your accept, decrease, or decline, access - later on the May 1st acceptance date

If you are a returning pupil, this option will exist available once y'all accept been offered your financial assist in mid-June.

Click hither for more than information nearly how to take, decrease, or pass up your loan and/or work report offers:

![]()

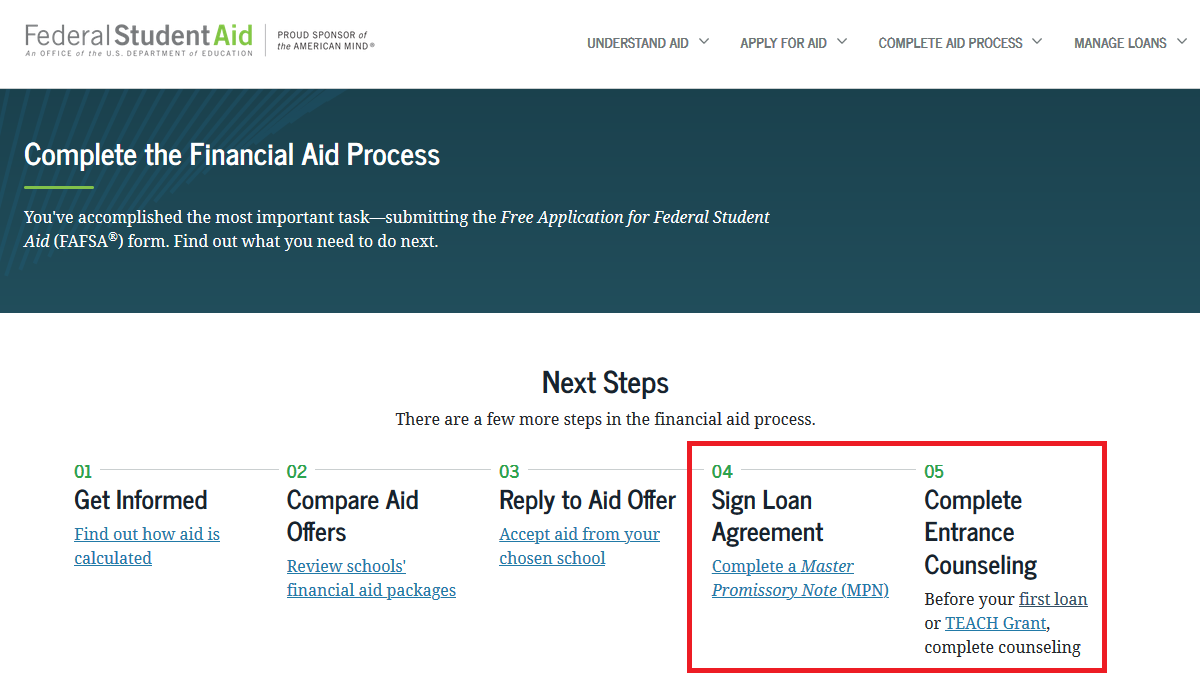

Federal Loan Requirements

Once your financial aid has been adapted and/or accepted, first-fourth dimension borrowers will need to consummate:

- Loan Archway Counseling

- Master Promissory Note (MPN)

In nigh cases, y'all will simply need to complete these items in one case during your higher career. You can complete these requirements at any time once you have been accepted to Penn Land. Once we brainstorm to process your loan(south), these items volition exist presented to you in your 'To Practice List' in LionPath if they are yet incomplete. In one case these items are completed on studentaid.gov, notification volition exist sent electronically to us in approximately two-3 business concern days. At that time, your To Do Listing detail volition be removed from your LionPath tape.

Transfer Monitoring

Federal regulations require Penn State to confirm whether or not you accept taken credits at another establishment during the nigh recent academic year. Updated federal loan (and federal Pell) information from the National Student Loan Data Organisation (NSLDS) will exist requested to verify this information, and a temporary hold will be placed on your tape.

If you have not used federal assist in the nigh recent bookish twelvemonth, you will not take to accept whatever activeness. Once the updated information loads in 8 - 10 days, the concur will automatically exist removed from your record.

If you lot accept used federal help in the most recent academic yr, or if you lot take assist pending at another institution you should be in contact with that school to abolish the aid at the Mutual Origination and Disbursement (COD) Organization federal database. Nosotros will manually review your record, make any aid adjustments if necessary, and remove the hold.

This concur will not interrupt the awarding of financial aid or scheduling your courses; however, it will prevent your help from disbursing until the review of your tape is complete.

Respond to Verification

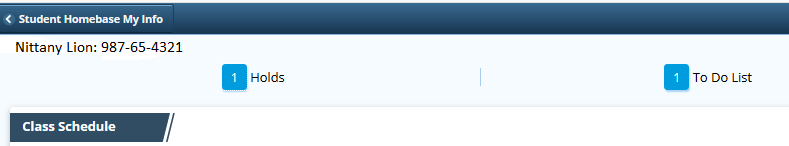

Verification will exist presented to yous in your 'To Do List', (if you are selected), later you have responded to your offer of access.

Verification is a federal mandate requiring universities to confirm the accurateness of the data reported on the Gratuitous Awarding for Federal Pupil Aid (FAFSA). Yous will receive an electronic mail from our part, which explains what documentation must exist provided if you lot are selected for verification. Verification requests volition too exist displayed on the "To Do List" located on the Home page of your LionPATH account.

Follow all directions, and respond quickly to this request to avoid a delay in the processing of your aid. Parental signature is required on the verification documents for dependent students.

Your To Practise List Detail volition prove equally "Received" once the information is received, reviewed, and so manually updated by our role. This is not automatically updated when you upload the item(s). The to exercise list is typically updated in approximately 3-five business organization days, unless we are in peak processing when volumes increase dramatically.

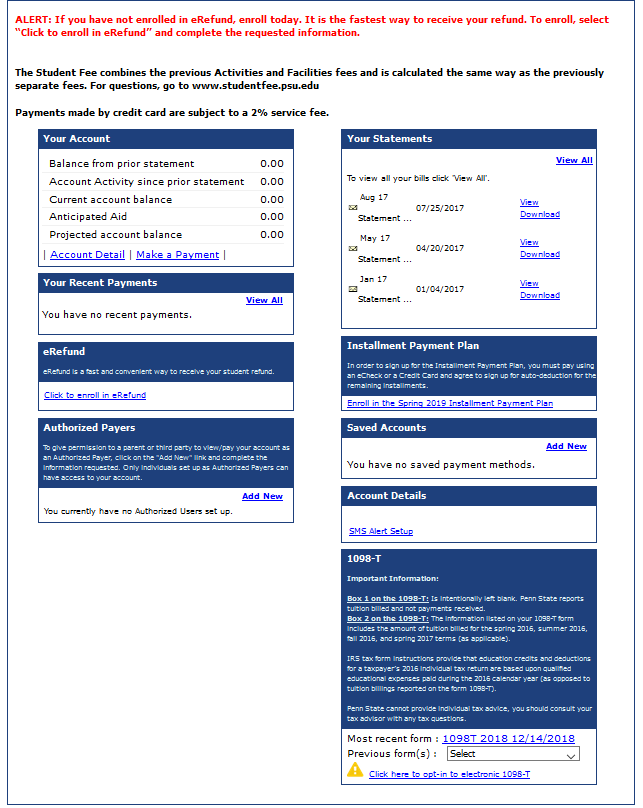

Loans as a Credit on Your Student Account Statement

Billing begins in early Baronial for fall semester, January for spring semester, and May for summer semester. Your Direct Subsidized/Unsubsidized loans volition appear as predictable aid on your educatee account statement one time y'all have:

- Met the minimum eligibility requirements

- Accustomed the loans in LionPath

- Completed your Federal requirements (MPN/LEC)

- Complied with verification (if selected)

Disbursement of Funds

After you have completed all of the steps to finalize your aid and semester classes begin, your financial aid volition disburse into your account and exist credited towards your tuition nib. Pay special attention to your LionPATH Pupil Middle for whatever Holds and To Practise List items as this may prevent the timely disbursement of your aid.

Per federal regulation, we can begin the disbursement procedure of federal funds no before than ten days prior to the semester begin date.

Summer term

Summertime loans will not be disbursed at the beginning of the semester. The disbursement date will be x days prior to the start of Session 2. For Summer 2022, the appointment will exist June 20, 2022. Short term loans are available at your campus help function for students who have started their classes in May and are expecting a refund to pay for living expenses.

Educational activity Abroad

Student's attending an Education Away programme volition accept their loan(s) disbursed in 2 divide disbursements per federal regulation.

Reminders:

- You will receive your loan disclosures from your federal direct loan servicer indicating that this date will be your actual disbursement appointment, however, this is only an estimated appointment of disbursement.

- The procedure to request Federal Direct Loan funds and disburse them into your educatee business relationship will accept approximately 3-v business days.

- Exist aware that once the funds disburse, they will no longer prove as anticipated help. All the same, inside the same 24-hour interval, you volition see the funds posted to your educatee business relationship.

- Monitor your PSU email for messages regarding aid disbursement and refunds.

- Monitor your National Student Loan Database System (NSLDS) data (by logging into studentaid.gov) for loan disbursement updates and loan servicer assignments.

Can I Still Register For Subsidized Loan After Fafsa,

Source: https://studentaid.psu.edu/types-of-aid/loans/federal-direct-loans/federal-direct-subsidized-and-unsubsidized-loans/subsidized-unsubsidized-timeline-to-disbursement

Posted by: kincannonfulies.blogspot.com

0 Response to "Can I Still Register For Subsidized Loan After Fafsa"

Post a Comment